There are more than 250 POS companies with installs in groups and chains with more than 5 units in the US and Canada.

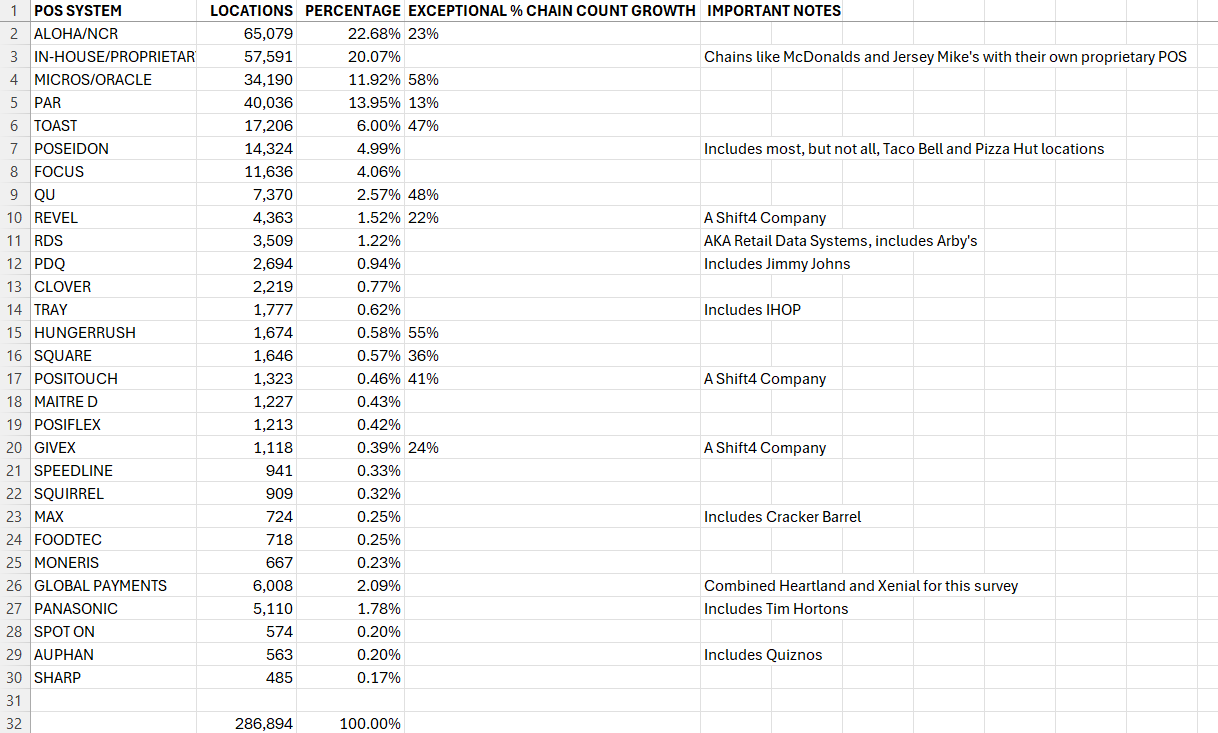

Fresh survey results are in. The Top POS companies in the US and Canada:

Results:

Our survey encompassed 3,150 chains with five or more units. There are more than 250 POS companies with installations in groups and chains with 5+ units.

There was significant Enterprise growth in the following POS providers: Aloha, Micros, PAR, Toast, QU, Revel, Hungerrush, Square, Positouch, and Givex. Shift4 is the parent owner of Revel, Positouch and Givex.

Restaurantdata takes into account the understanding, some POS companies utilize a variety of POS providers and location fulfillment transcends through 286,894 locations. Also taken into account is the migration of some POS companies towards new providers.

- No Change in POS:

2,363 chains maintained the same POS system as reported in our initial survey (Fall 2024) and this survey (Spring 2025).

- New Responses:

209 chains that did not respond previously provided responses this time.

- No Response:

303 chains did not respond to either survey. 95% of no response groups and chains are in companies with less than 20 locations.

- POS Changes:

275 chains reported a different POS system compared to the previous survey.

When reporting chain count increases, we accounted for no-change in POS results, new responses, and POS changes.

Updates in This Survey

✅ Included:

- Expanded the In-House Proprietary category.

- Heartland and Xenial were consolidated under Global Payments.

- Panasonic and IQ Touch merged into Panasonic.

❌ Excluded:

- Hardware data.

- Removed and consolidated “Various” and “Register” categories, as they referred to basic POS systems lacking typical features.

Key Observations

📈 Shift Toward In-House Solutions for larger chains:

Larger chains are increasingly developing their own POS systems.

🌐 Integrated Online Ordering:

Many POS providers now offer online ordering solutions for both their clients and restaurants using competing POS platforms.

Important Notes

🔄 We plan to maintain our omnibus Fall/Spring survey cycle with the next survey scheduled for Fall 2025. Continued data collection will deepen our insights into the evolving POS landscape.

👉 Stay tuned for future updates!

Disclaimer: The information provided herein is for general informational purposes only and does not constitute financial, investment, or legal advice. We are not investment advisors, broker-dealers, or fiduciaries, and no part of this survey should be interpreted as a recommendation or endorsement of any security, investment strategy, or financial instrument. While we endeavor to provide comprehensive responses, individual responses may vary over time and may not align with prior or future responses.

This survey is purely informal and non-scientific, designed to gather and share general insights without any guarantee of accuracy, completeness, or reliability. It is conducted in an impartial and unbiased manner, and neither Restaurantdata nor any officers or employees hold any ownership interest in, or maintain any financial position with, any publicly traded companies referenced herein. Participants should conduct their own due diligence and consult with a qualified investment professional before making any financial decisions.

Frequency Updates

Companies who want monthly updates and review of specific chains should contact us for further information.